Cryptocurrency: A new paradigm of transferring wealth

Are you curious about whether age shapes views on cryptocurrencies? Coincover’s latest comprehensive research uncovers some intriguing trends, challenging the notion that age dictates one’s stance.

Surprisingly, individuals aged 55-64 maintain a positive outlook on the crypto market. However, attitudes and adoption rates toward cryptocurrencies can differ across age groups. In this blog, we delve into the current trends in the market and how this might affect the future adoption of crypto. With older and younger generations adopting cryptocurrencies, it raises the question: could crypto be used as a vehicle for wealth generation?

Do feelings on crypto differ across generations?

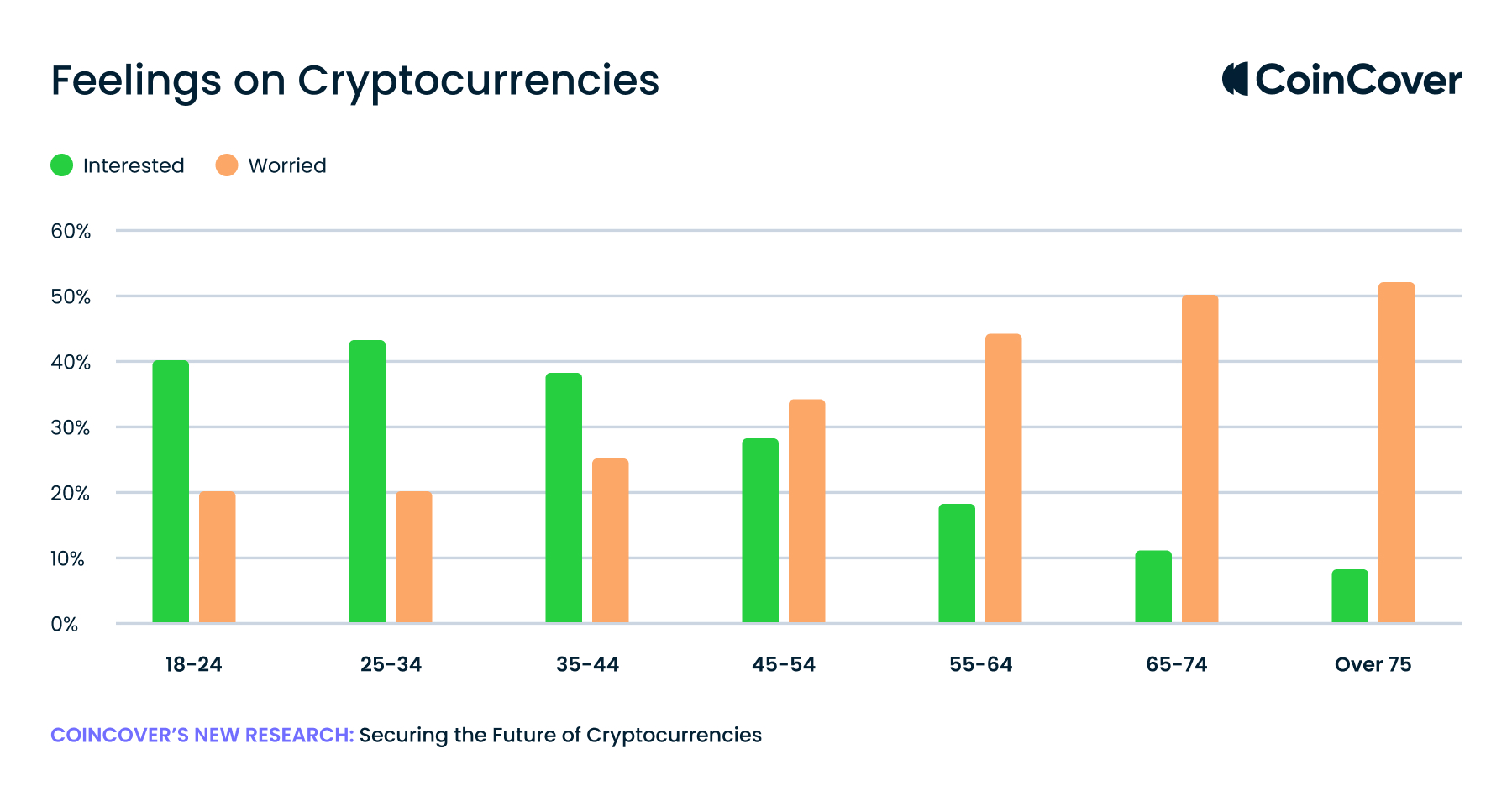

Data from Coincover’s survey finds ages 25-34 are the most interested in cryptocurrencies with 43% saying they are indeed interested. Ages 45-54 aren’t too far behind with 28% of respondents saying they are interested in crypto. However, the survey data also show that older generations are more worried about cryptocurrencies than younger generations, it’s important to understand why so we address these concerns.

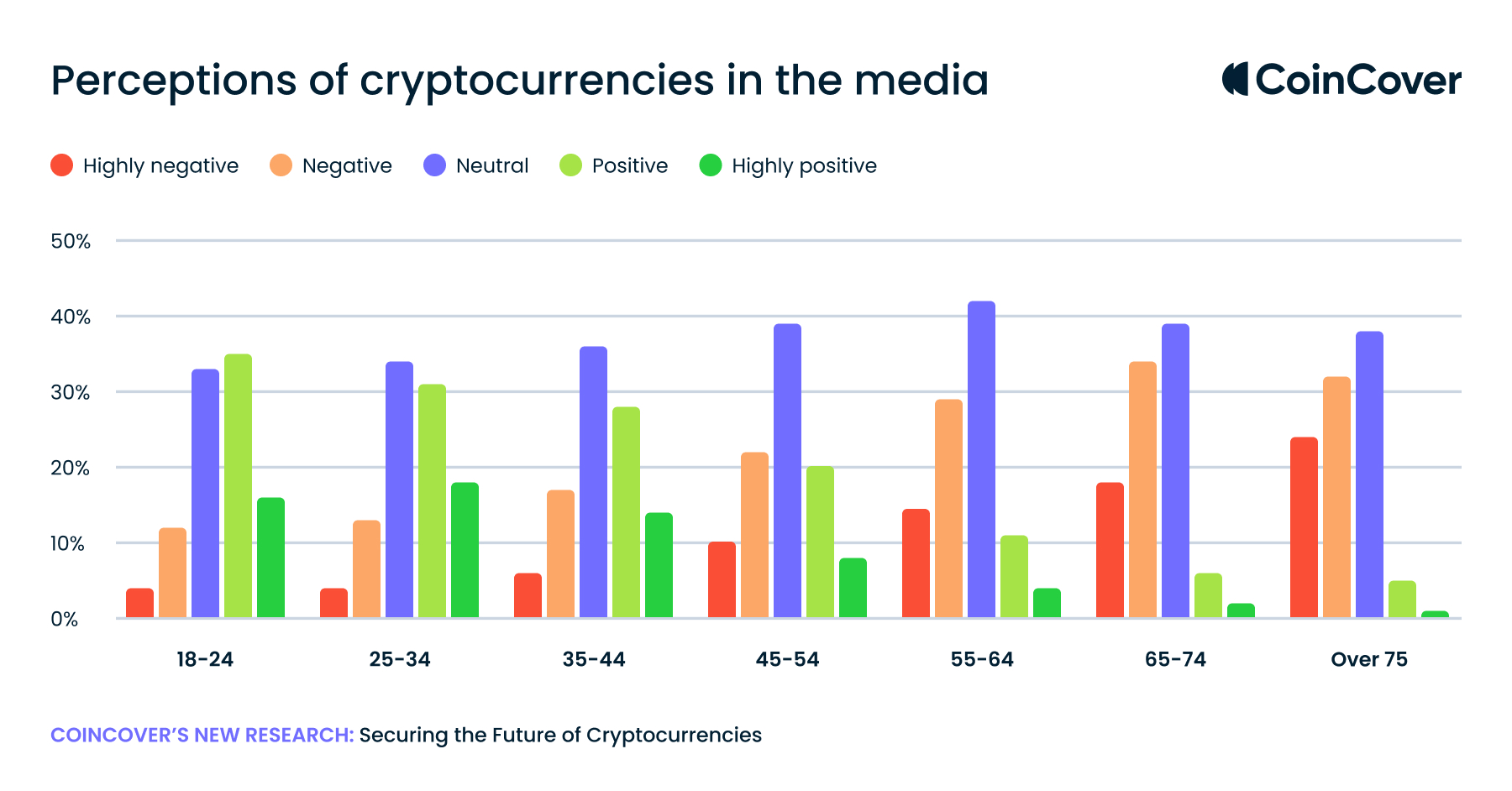

Coincover’s survey also researches the perception of cryptocurrencies in the media. Whilst most respondents (37%) were neutral about views of crypto in the media, the second highest majority (24%) stated positive perceptions of crypto in the media. However, the majority of negative perception came from older generations. Despite this, only 24% of over 75-year-old and over group held a highly negative view. Ages groups 18-24 and 25-34 remained similar in positive sentiments and held an overall positive view on cryptocurrencies. Disappointingly, age groups 45-54 and beyond had declining positive perceptions of cryptocurrency in the media.

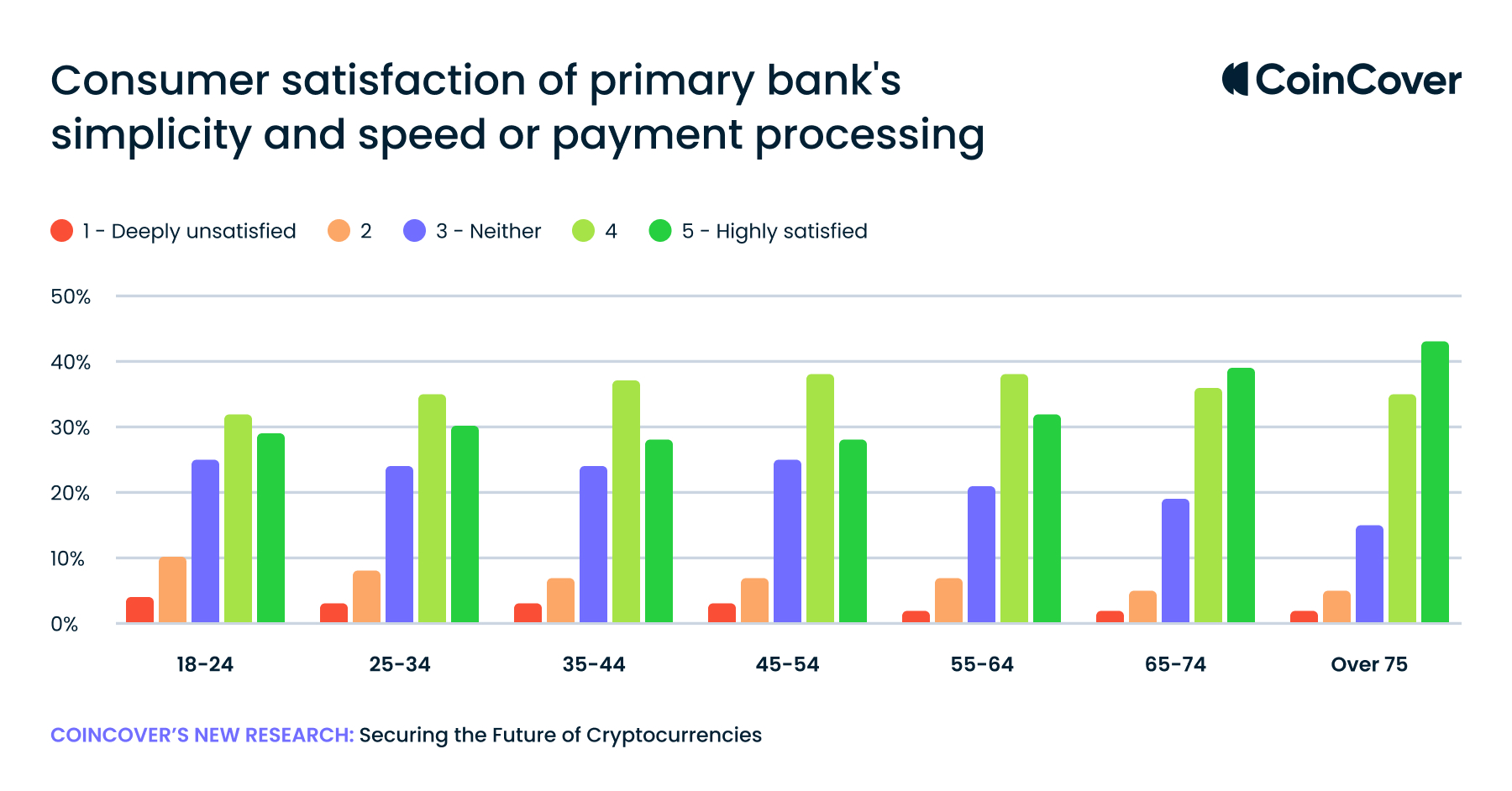

The variation in how different age groups perceive cryptocurrencies may stem from their levels of satisfaction with traditional banking systems. Those who are highly content with traditional banking are less inclined to explore the realm of cryptocurrencies to reap their advantages.

How does this compare with High-street banking?

Coincover’s survey data reveals that older age groups exhibit greater satisfaction with their primary bank’s simplicity and speed of payment processing when compared to younger generations. Remarkably, 43% of individuals over the age of 75 report high satisfaction, whereas only 29% of those aged 18-24 and 30% of individuals aged 25-34 express similar levels of contentment regarding their bank’s payment processing efficiency. This discrepancy may provide insight into why older generations display less interest in cryptocurrencies relative to their younger counterparts, as they perceive fewer benefits in adopting digital currencies due to their higher satisfaction with traditional banking systems.

Does risk appetite play a role in perception?

A more refined analysis of the data collected from Coincover’s survey uncovers a compelling trend: individuals within the age groups spanning 55 to over 75 years tend to exhibit a lower risk appetite, progressively growing more risk-averse as they advance in age. A closer examination shows that this growing reluctance to take financial risks among older generations stems from a practical limitation – the inability to afford such risks. Consequently, it is reasonable to speculate that older generations may be less inclined to engage in cryptocurrency trading, primarily due to their financial constraints. This connection is further underscored by the fact that the legal age for claiming a state pension in the UK is currently 66 years old, shedding light on why those eligible for pension may be hesitant to allocate their funds to what they perceive as a risk venture such as cryptocurrencies.

Is financial visibility key?

Interestingly, a trend emerges when comparing the sentiment of younger and older generations towards the visibility of their money. Notably, 20% of respondents aged 18 to 24 express contentment when they can easily monitor their financial assets using online banking services, while only 14% of individuals aged 55 to 64 and a mere 12% of those aged over 75 share this sentiment. This difference could be attributed to the contrast in familiarity with traditional banking systems, as older generations may have less experience with online banking. Data from UK Finance suggests that younger age groups have embraced digital banking services with more excitement, especially in the wake of the pandemic. In contrast, individuals aged 55 and above exhibit a more pronounced reluctance towards utilising digital banking systems. Given that cryptocurrencies are almost exclusively accessible through online or digital platforms, a parallel can be drawn between this digital hesitance and a lack of enthusiasm for cryptocurrencies among older generations. It can be argued that many crypto enthusiasts derive pleasure from closely monitoring the dynamic crypto market, which contrasts with the disinterest of older generations in tracking their finances through digital means.

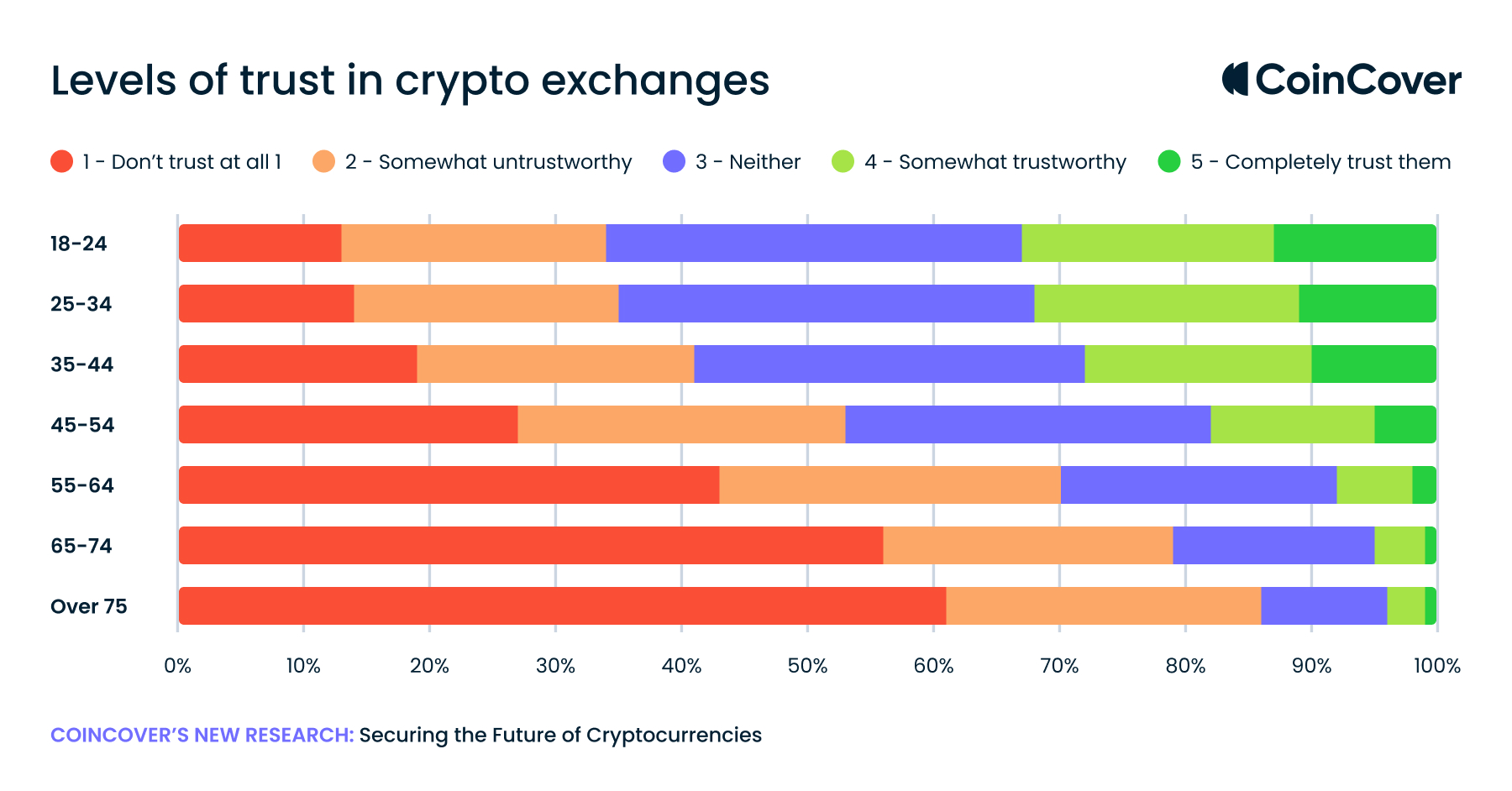

The role of crypto exchanges in building trust

One of the most prominent sentiments to derive from the report shows that as age increases, so does consumer distrust of crypto exchanges. For 18–24-year old’s 12% of them have complete trust in crypto exchanges, compared to only 2% of crypto 55-64 and 1% of 65 and over. An even more drastic difference shows when looking at consumers who don’t trust crypto exchanges at all. Of ages 18-24, only 13% don’t trust crypto exchanges at all and 14% of 18-24. This percentage dramatically increases for each older age group. Notably, 43% of those ages 55-64 don’t trust crypto exchanges at all, 56% for 65-74 and 61% for over 75.

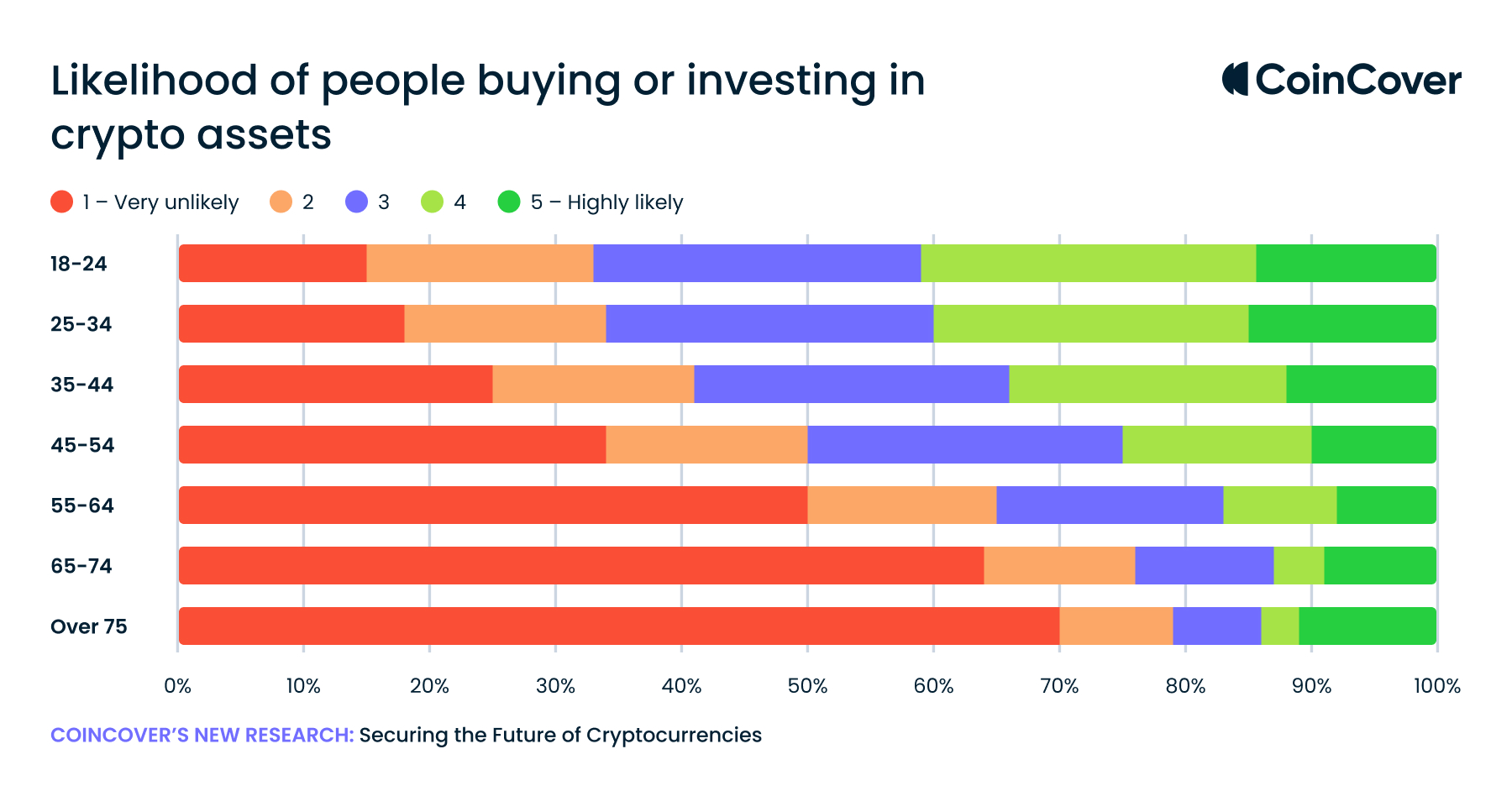

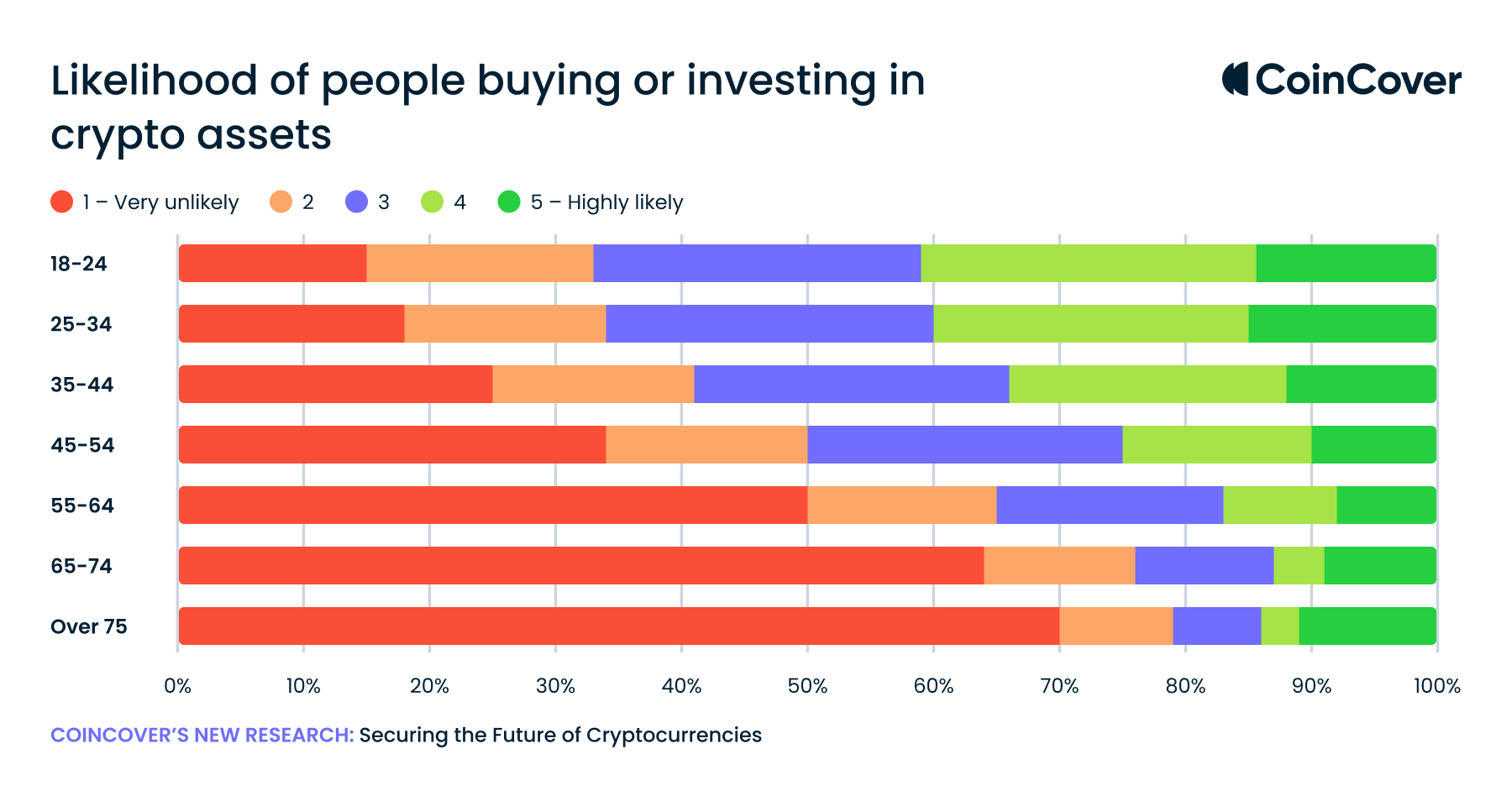

However, in contrast to the above sentiments, Coincover’s research finds little difference in the likelihood of purchasing or investing in crypto assets across generations. Notably, the enthusiasm dips slightly for those aged 45-74, with 14% of 18-24-year-olds and only 12% of individuals over 75 expressing a high likelihood of involvement. Strikingly, just 8% of those aged 55-64 show a strong inclination to buy or invest in crypto assets.

Examining the unlikelihood of crypto adoption, a significant 70% of individuals over 75 express strong reservations, while merely 15% of 18-24-year-olds share the same sentiment. This shows pronounced generational differences, indicating a more substantial appetite for cryptocurrency among the younger demographic. The question arises: can the modest interest in cryptocurrencies among older generations serve as a vehicle for wealth generation? Alternatively, might younger consumers leverage it to transfer wealth to subsequent generations?

Despite crypto’s volatility, identified as a major adoption barrier in Coincover’s ‘Securing the Future of Cryptocurrencies’ report, younger individuals exhibit a notable attraction. The appeal lies in the accessibility of cryptocurrencies without the need for a financial advisor- a feature resonating with the younger demographic’s independent and research-driven approach.

In conclusion, as we explore the paths of age and cryptocurrency perceptions, a nuanced theme emerges. While age groups display varied sentiments towards digital currencies, a consistent theme revolves around the potential for cryptocurrency to act as a transformative vehicle for wealth generation. From heightened interest among the younger demographic to pragmatic considerations of the older generation, each age group’s unique stance reflects a complex interplay of familiarity with traditional banking, attitudes towards risk, and trust in crypto exchanges.

The survey underscores the evolving landscape, emphasizing that as age increases, so does consumer distrust of crypto exchanges. Yet, the research surprisingly reveals that this scepticism does not significantly impact the likelihood of purchasing or investing in crypto assets across generations.

The question of whether cryptocurrency can bridge generational wealth gaps lingers. With the potential for older generations to harness this evolving financial landscape for wealth generation or younger demographics to use it to transfer wealth to subsequent generations.

Despite concerns about crypto's volatility, younger individuals remain attracted, drawn by the accessibility that allows them to engage without the need for a financial advisor. As we navigate this paradigm shift, it becomes evident that cryptocurrency is not merely a digital currency but a catalyst for redefining financial autonomy and wealth dynamics across generations. The journey continues, and only time will unveil the full extent of cryptocurrency's impact on shaping the future of wealth transfer and financial empowerment.

Download our latest report, "Securing The Future of Cryptocurrencies", to find out more about the latest and future trends.