Enterprise-grade crypto security for retail

The effort crypto service providers put into making crypto safer for investors is paying off. In 2024, the number of cryptocurrency owners increased by 13%, from 583 million to 659 million. Until now, the focus on cybersecurity and safety has been on institutional investors. However, the increase in retail users has seen risk mitigation companies such as CoinCover recognise that protection measures must also be put in place for these investors.

Trust is everything

For the retail investor, the needs are clear: keep my assets secure. If I lose access to my wallet, help me get back into it. If someone steals my crypto, get it back for me or repay me for what I’ve lost. Exchanges and wallet providers invest heavily in preventing fraudulent activity and implementing security measures to protect funds, but they’re fighting a constant battle as hackers regularly find new ways to exploit the market.

For example, AI is being used for deepfake scams where, for example, fake videos of celebrities are being used to get people to invest in phoney crypto schemes and in the future, hackers will use AI tools to bypass facial recognition in identity verification systems and steal assets from people’s wallets. One of the fastest-growing scams is approval phishing through smart contracts. Here, someone gets tricked into giving a malicious smart contract permission to access their wallet by connecting to a site or dApp that looks legitimate, approving a transaction, and the scammer can then empty their wallet.

And it’s not just the scams and negative publicity that crypto service providers have to deal with when trying to build trust with retail investors:

Price volatility: Brings a fear of losing investments, which means crypto is perceived as risky and unstable.

Lack of consumer protection and regulation: Retail users are used to investing in a regulated environment where consumer protection is guaranteed through schemes like the Financial Services Compensation Scheme (FSCS) in the UK and the Federal Deposit Insurance Corporation (FDIC) in the USA.

The user is responsible for security. Unlike in traditional finance, where the financial service provider manages money on investors behalf, in the crypto world, investors are responsible for the security of their investment. If they lose their keys, they lose their assets. If they send a transaction to the wrong wallet, there’s no way to get it back.

Crypto seems complicated: It’s technical and confusing to newcomers to the market. You need keys for a wallet, there are gas fees, nothing is centralised, and you can earn more money by staking. Education is essential to help people differentiate between genuine and scam schemes.

Are the tools up to the job?

Building consumer trust is by far the most significant challenge crypto providers face if they want to bring more users to the retail market. To do this, many have tried to adapt the technologies used in traditional finance to deal with fraudulent activity. However, while these tools are adequate for systems with known users and centralised systems, there are unique risks in crypto that these traditional tools can’t deal with.

Scams can bypass current fraud protection tools, as TradFi tools aren’t set up to detect scams like phishing or malicious dApps. Social engineering or approval phishing may not trigger alerts as it looks like the user approved the transactions themselves. And standard fraud tools won’t look at blockchain-specific issues like wallet address connections, smart contract behaviour or trace on-chain patterns, leaving a massive gap in fraud identification.

On the other hand, CoinCover’s risk mitigation platform has been designed for the crypto market- a decentralised, immutable, user-controlled environment. It provides crypto-native security layers specifically to protect retail users, who typically use platforms like exchanges and onramps, which are prime targets for fraud and hacks.

Introducing: CoinCover for Retail

Give your customers total protection against fraud

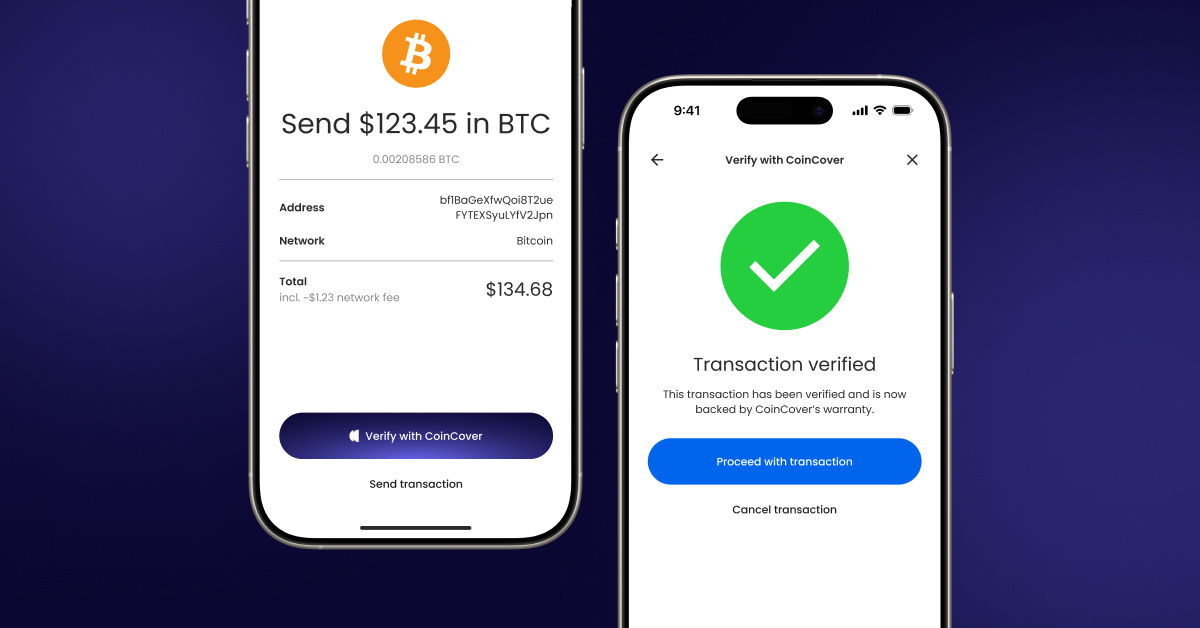

CoinCover Protect provides real-time crypto fraud prevention specifically designed for retail investors. Unlike other monitoring solutions, our system:

- Validates transactions before execution to prevent fraud at the point of origin

- Offers warranty-backed protection that provides full protection for your customers

- Can be seamlessly integrated into your own UI and UX

This is protection that doesn't just prevent losses. It builds confidence at the crucial moment of transaction, increasing conversion rates, reducing abandonment and providing differentiation in a deeply competitive market.

Attacks on exchanges

Exchanges are a cybercriminal’s Aladdin’s cave. Stuffed full of valuable assets and user data, their custodian status means they hold billions of dollars worth of crypto. Unlike traditional financial institutions, they often lack the protection needed to make them attractive to retail investors, such as insurance and consumer protection.

Due to the complicated nature of their setup (they use several systems, including APIs, trading engines, wallet infrastructure, KYC systems, and front-end customer apps), their attack surface is huge. It means there are many places a hacker can try to infiltrate to get access to users’ funds. Hot wallets are particularly vulnerable to attack as they are connected to the internet and can be exploited in real-time if the wallet’s private key is compromised.

CoinCover uses a multi-layered screening solution to evaluate blockchain transactions. Our risk engine identifies legitimate and suspicious transactions and notifies users of potential threats in real-time. By continuously monitoring transactions in real-time, CoinCover prevents the permanent loss of funds for retail investors, as once a transaction is broadcast to the blockchain, it can’t be reversed. Through identifying irregular patterns and flagging suspicious activities, our risk engine warns users that their wallets may be being compromised, meaning they can decide not to send a transaction and prevent the unauthorised withdrawal of their funds.

Vulnerabilities for Onramps

Because they act as an entry point for people to move fiat to the crypto world, Onramps have their own challenges when protecting their users. The opportunity to steal both crypto and fiat makes them an attractive prospect for cybercriminals. They also appeal to money launderers who want to move funds between traditional finance and the crypto ecosystem.

Added to this is the fact that they're often used by new crypto users, who may not have the same understanding of how crypto works and are more easily deceived by scammers. For example, a user could be phished or tricked into sending their crypto to a scammer. Onramps generally let their customers send funds directly to wallets, which means they can’t get them back once those funds have gone.

CoinCover's transaction protection technology screens all transactions sent from a wallet against a proprietary database of validated malicious and sanctioned addresses. If it identifies a transaction as going to a suspicious address, it lets the sender know and gives them the option not to send the transaction, protecting their funds.

Common security challenges

Regulation

Exchanges and onramps also face some common security issues. Regulation is not as prevalent in the crypto world as it is in traditional finance, and in some jurisdictions, there is no regulation at all. It means that security frameworks may not be as robust, and fraud prevention programmes can lack depth as they try to keep up with the introduction of new strategies to defraud users.

Governments worldwide are ramping up regulatory requirements. Significant developments have been made aimed at improving consumer protection and financial stability. In the USA, Congress has been asked to take action to establish a regulatory framework for stablecoins. In the EU, the European Union's Markets in Crypto-Assets (MiCA) has been in force since December 2024, providing a regulatory framework for member states, and in the UK, the government announced a roadmap for regulating crypto, which they aim to have in place by 2026.

CoinCover’s risk mitigation platform can help crypto service providers get ahead of the regulatory curve. By acting as a trusted third-party service provider, we provide an extra layer of resilience to protect retail users’ digital assets, helping organisations evidence that they are exceeding their requirements to protect customers’ funds and combat financial crime. CoinCover also helps firms develop and test their business continuity plans, enhancing operational resilience.

Consumer protection

As discussed earlier, retail crypto investors don’t benefit from the same protection schemes that traditional finance offers. The UK’s FSCS provides consumers with a range of compensation amounts depending on the financial institution involved. For example, they will pay up to £85,000 if a bank fails. Similarly, in the USA, the FDIS will pay up to $250,000.

The lack of guaranteed protection is off-putting to people considering investing in crypto. CoinCover helps bridge this gap with its unique warranty* that combines proactive risk management with financial protection, safeguarding users against potential losses.

CoinCover offers a warranty that protects against the theft of crypto assets. Our technology is insured, meaning if our risk engine validates a transaction and it turns out to be malicious, customers can make a claim under our warranty for their lost funds. ** It gives retail investors extra protection as not only are their assets proactively protected through transaction monitoring, but they also benefit from financial protection against loss.

Benefits to crypto service providers

For crypto service providers, CoinCover provides the opportunity to stand out from competitors by using a threat detection service that protects customers' transactions in real time, ensuring their wallets and crypto transactions are safe and secure.

By introducing enhanced security features to their users, they can increase trust and attract new customers, for whom protecting their assets from loss is their primary objective when choosing a service provider. They will likely retain more current customers by improving trust and satisfaction.

Finally, CoinCover can provide platforms with a significant new revenue stream through our revenue-sharing model. Organisations can earn a portion of the fees charged for each protected transaction or subscription a customer signs up for.

Focusing on protecting crypto retail users is essential to growing the industry. As the crypto ecosystem matures, regulation is becoming mandatory, and more importantly, customers are demanding the same rights as they have in traditional finance.

Get in touch with us today to learn more about our services and how they can help your business meet these needs.

* Coincover is not an insurance company; you are not buying insurance when signing up for our services. Our technology is insured, meaning we can offer customers a warranty that if our technology fails, we can compensate you.

** Claims are subject to specific exclusions and claim limits as stated in CoinCover Protect End User Terms of Use